Keeping Tabs on Your Kids’ Spending With Digital Banking

I’m the proud father of four kids, including one teenage boy. As a parent and the Connexus Digital Banking Manager, I’ve learned Account Notifications are a great way to help my teenager manage his money.

Last year, my wife and I helped my son become a member of Connexus and we opened an Xtraordinary Checking Account for him. We set it up so he is the primary owner and I am the joint owner. That way it gives him the independence he wants and gives me the supervision I want.

Since there are multiple account owners, we’re both able to access this account through our own separate Digital Banking accounts. After personalizing his Digital Banking profile and getting his user settings the way he wanted, we made sure to set up Account Notifications through email, text, and push notification.

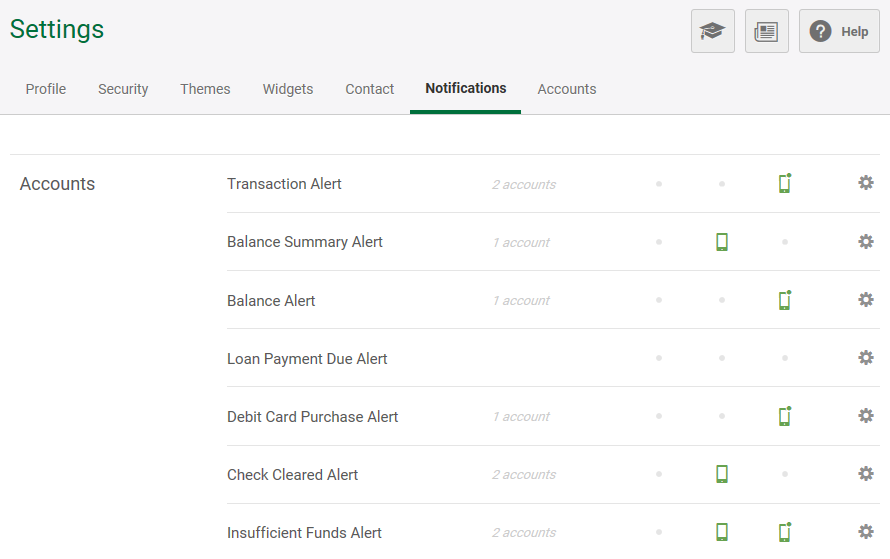

These are the alerts we set up and why:

Daily Balance Summary Alert

This lets us both know the account balance every day. I wanted both of us to know if the account is at risk of overdrawing.

Insufficient Funds Alert

Speaking of which, if the account does get overdrawn, this alert will let us know. That will be another teaching moment.

Debit Card Purchase Alert

This will make sure he is aware of any debit card charges. Some merchants won’t process transactions instantly, so if his debit card purchase alert is delayed, the transaction may not be posted quite yet. He set the minimum amount for this alert to be $1.00 to ensure nearly all transactions will be recognized.

Transaction Alert

As the primary financial manager in my family, this is probably my favorite alert. I use this for any debit or credit transactions to my accounts over $1.00. I know when my paychecks come in and my mortgage payments go out. It’s a great way to track activity. That’s why my son did the same for his account.

Check Cleared Alert

We ordered my son checks in case he would need them. Explaining to a teenager how checks work was unexpectedly challenging. But we set up this alert to notify him when a check is cashed and the funds leave his account.

Having these alerts have helped my son be more responsible with his money, and it helps me monitor his account for any unusual activity. Keeping up with transactions and activity is important. It’s equally important to have a plan. I teach my son to be proactive with planning his spending rather than reactive. Using the budget tool and savings goals are two keys to proactive money management. See last month’s post to learn more about savings goals and budgets alerts.

If you want to set up any Account Notifications for yourself (or see all the notification options), check out our Digital Banking page.