Your Guide to Personal Cybersecurity

In today’s world, protecting your digital data is more important than ever. Since the introduction of EMV chips on most credit and debit cards, fraud at physical locations has decreased. Unfortunately, those criminals are now heavily targeting online channels, and if you’re not prepared, you could be vulnerable.

We want you to stay safe whenever you’re connected online. To help you out, we broke it down by medium and talked to some of our in-house security experts. Here’s what you need to know:

Passwords: Secure Your Login

Think about how many password protected accounts you have (Digital Banking, Netflix®, Facebook®, etc.). Chances are, it’s more than 20. Maybe more than 40. How can you be expected to remember that many different high-strength passwords?

Many cybersecurity experts say using a password manager is one of the easiest ways to protect your accounts. A password manager is a tool that securely generates, encrypts, and stores unique passwords for each of your accounts. Instead of using “Password” or “123456” for everything, a password manager will create un-guessable passwords for you and provide them to you when needed.

There are locally installed and cloud-based options, so we encourage you to research the best tool for you.

What You Should Do

- Determine how many password-protected accounts you really have.

- Consider migrating your passwords into a password manager.

- Enable multifactor authentication wherever possible (the extra step keeps you safer).

- If you no longer use an account, delete it or have it deactivated.

- Ensure you aren’t using the same password for multiple accounts.

Email: Secure Your Inbox

Your email address is a deeply tied to your online presence. It’s used to sign up for everything from Digital Banking to online shopping sites. In the past decade, we’ve seen multiple large companies suffer email breaches. That makes your responsibility to secure your own account even more crucial.

What You Should Do

- Avoid opening emails from senders you don’t know or recognize. Delete them immediately.

- Don’t click on any links or open any attachments in suspicious emails.

- Set up multifactor authentication for an extra layer of login security.

- Make sure your password is strong and un-guessable.

Security Tip From the Connexus Fraud Department

Take a sentence and abbreviate it as your password. Example: Wow!tb@MCDwaGr8 = Wow! The burger at McDonald’s was great.

Social Media: Secure Your Profiles

Social media is an incredible innovation. It empowers billions of people to share and connect with others across the globe. While it’s highly beneficial, it also makes people more vulnerable to scams. Here are some of the most common ones to look out for:

Catfishing

This is when a scammer creates a mock social media profile to bait you into a fake online relationship. The scammer then builds trust and leverages the relationship to get money or other valuable benefits from you.

Profile Hijacking

There are two forms of profile hijacking to look out for. In one scenario, a scammer will hack into your profile and change the password, essentially locking you out. (That’s why you need a strong password!) The other scenario involves the scammer pretending to be you by creating a profile identical to yours. In both cases, the scammer will often reach out to your friends for money.

Data-Mining Quizzes

Your Facebook newsfeed may be full of fun quizzes to find out things like who your celebrity soulmate is, or which superhero you are. While those can be entertaining, you have to be careful. Some quizzes from unrecognized sources could include hidden links that can steal your personal information, or they could be gaining personal information from the quiz to hack your passwords.

URL Shorteners

The URL for the Connexus website is https://www.connexuscu.org/. You can tell by looking at it that you’re going to the Connexus Credit Union website. If you use a URL shortener on it, the same URL could look like this: https://bit.ly/2suY0Tq. It still takes you to the Connexus website, but you can’t tell by simply looking at it.

A scammer could trick you into thinking you’re going to be directed toward a reputable site, but the shortened URL could actually be linked to a page that leaves malware or directs you to another scam. Short URLs are common on Twitter® because of the character limit, so be sure you trust the source of the URL.

What You Should Do

- Avoid clicking on suspicious links and ads. Make sure you know and recognize the source.

- Ensure the passwords for your social media accounts are strong.

- Don’t take Facebook® quizzes created by brands you’ve never heard of or don’t trust.

- Never send money to someone you don’t know.

Digital Banking: Secure Your Accounts

With access to all your data and money, this is an area you definitely want to protect. When it comes to Connexus Digital Banking, we invest in countless resources to keep your accounts safe. The same cannot be said for all financial institutions, so make sure you’re always taking extra precautions.

What You Should Do

- Only access your Digital Banking account from a secure wireless network (not public).

- Make sure your Digital Banking password is strong and unlike any other of your passwords.

- Set up multifactor authentication for an extra layer of security.

- Opt for fingerprint or facial recognition login if your phone is compatible.

“According to the American Bankers Association, two thirds of Americans use online or mobile banking to manage their accounts. With more people managing their money digitally, it becomes even more important to secure your accounts!”

Justin Pearce

Connexus SDK Developer & Computer Security Expert

Online Shopping: Secure Your Cart

This presents one of the greatest fraud risks. Whenever you’re making online payments, you should be cautious. Make sure you’re taking appropriate precautions, especially during peak shopping seasons.

What You Should Do

- Make sure you’re using a secure wireless network when making online transactions. Your payment info could be tracked on a public network.

- Monitor your account to make sure no unwarranted transactions happen.

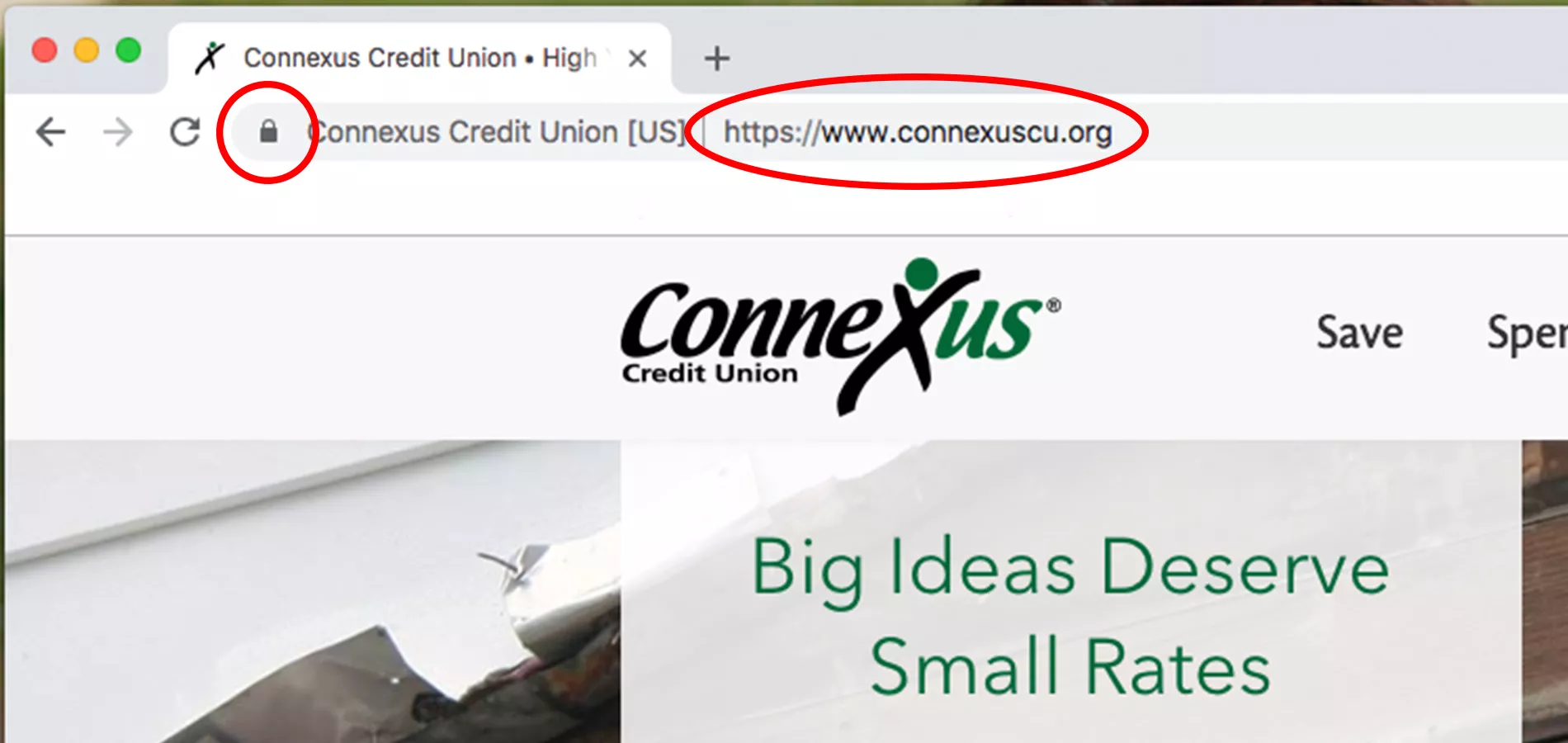

- Only shop at well known, trusted websites and brands. If you don’t know whether a site is reputable, research the company online, on social media, etc. Another way to tell is a site is safe is to look at the address bar on your browser. You want to opt for sites that have URLs starting with “https” instead of “http” and have a lock icon next to the URL. See the example below:

Mobile: Secure Your Phone

Your cellphone holds more personal data than you may think — it’s the gateway to your life! If someone gained access to your mobile device, you could be at serious risk of identity theft.

What You Should Do

- Keep your device’s software up to date.

- Add authentication to your device (passcode, fingerprint, facial recognition, etc) so it can only be access with the proper credentials.

- Only use secure wireless networks. Your information could be accessed by hackers from a public network.

- Uninstall apps you no longer use or ones that ask for too much personal information that you’re not comfortable providing.

- If your device supports it, enable device encryption to protect your data if your device is lost or stolen.

- Never leave your device unattended in a public place.

“Cell phones are no longer just phones. They hold a wealth of information, from calls and text messages to photos, email, documents, social media and more! All of this information can give a hacker just what they need to guess your password or answer your security questions.”

Justin Pearce

Connexus SDK Developer & Computer Security Expert

Your online protection is important to us. We invest countless resources to protect your accounts, but your attention to personal security makes a huge difference. Secure your information, update it regularly, and stay safe.